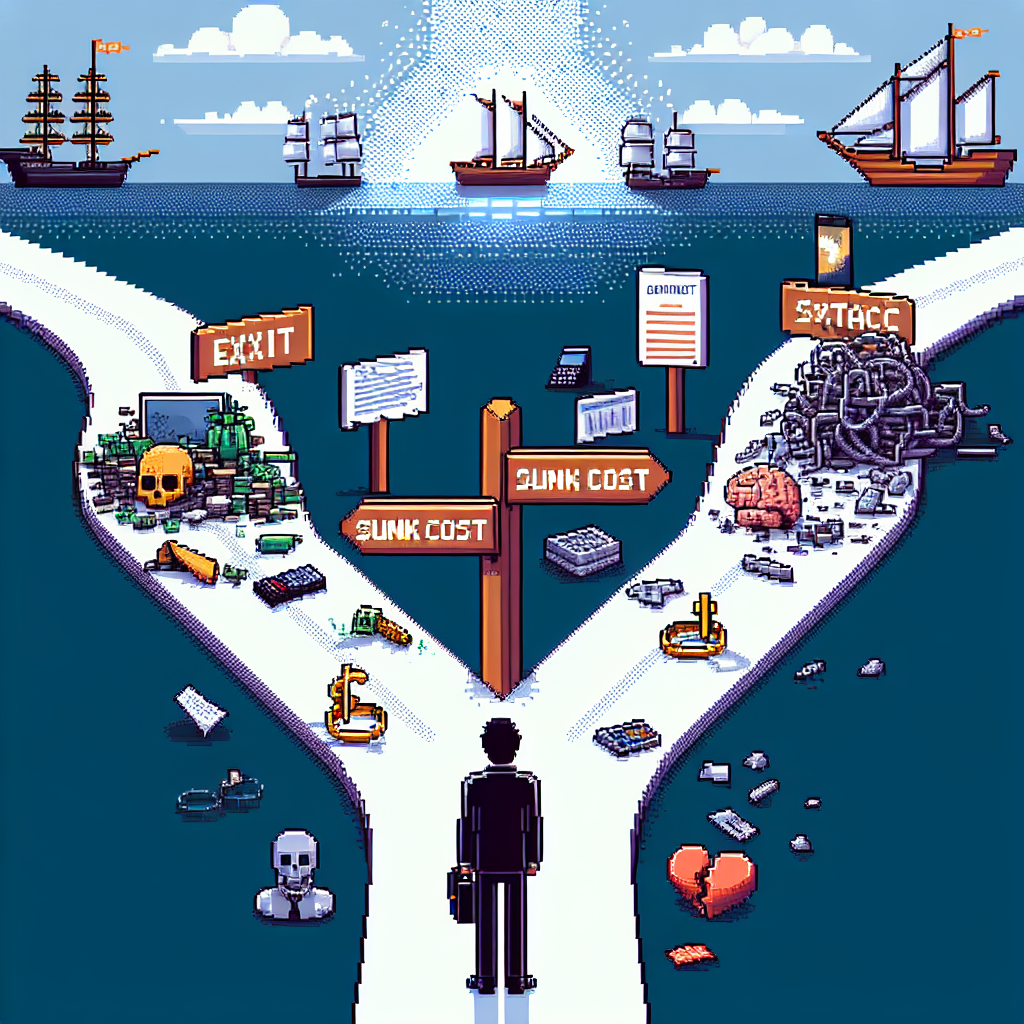

Sunk Cost Fallacy: An Introduction

Definition of Sunk Cost Fallacy

The Sunk Cost Fallacy is a cognitive trap where individuals or organizations continue a behavior or endeavor primarily because of previously invested resources like time, money, or effort, rather than evaluating the current merits of the situation. This fallacy often makes people irrationally stick with decisions, despite evidence that moving on would be more beneficial.

Importance of Understanding the Phenomenon

Understanding the Sunk Cost Fallacy is essential because it affects decision-making both personally and professionally. By recognizing this phenomenon, individuals can make more rational choices and avoid unnecessary commitments. Additionally, awareness of sunk costs helps in resource allocation and enhances efficiency, enabling better management of one’s life and business. Consequently, addressing this fallacy is fundamental in developing sound decision-making strategies and ensuring more positive outcomes in various aspects of life.

Historical Context of Sunk Cost Fallacy

Origins of the Concept

The term Sunk Cost Fallacy has deep roots, tracing back to early economic theories that sought to explain irrational financial behavior. It emerged because economists and psychologists began observing that people often made choices based not only on current value but also on past investments. During these early explorations, the fallacy was starkly evident in various scenarios where financial outcomes were negatively impacted by prior costs that could not be recovered. Despite the evolution of economic thought, this particular fallacy has stubbornly persisted, demonstrating its relevance over time.

Notable Historical Examples

Throughout history, the Sunk Cost Fallacy has manifested in numerous significant cases. One notable example includes the continued funding of expensive military projects despite clear signs of non-viability. Additionally, governments have often poured more resources into failing public works, justifying their decisions with the extent of previous investments. These instances highlight the widespread impact of the fallacy, not only on individuals but also on larger systems like governments and companies. Before modern understanding, it led decisions astray, reinforcing the necessity of recognizing and addressing it in both past and present contexts.

Sunk Cost Fallacy: Psychological Underpinnings

Cognitive Bias and Decision-Making

The Sunk Cost Fallacy is deeply rooted in our cognitive processes, influencing decision-making in a pervasive manner. This phenomenon arises from a cognitive bias where individuals continue to invest in a decision based on previous investments, regardless of the current value or future benefit. Because people tend to focus on the costs already incurred, they often struggle to evaluate the present situation objectively. As a result, choices are frequently skewed towards perpetuating past decisions rather than opting for objectively beneficial alternatives.

Emotional Attachment to Investments

Equally important in understanding the Sunk Cost Fallacy is recognizing the powerful emotional attachment to investments. During the initial phases of any project, people develop emotional ties to their investments, viewing them as extensions of their efforts and dedication. Despite rational evidence suggesting a change in strategy, these emotional bonds can lead individuals to stick with a decision, as letting go might feel like admitting failure. This attachment not only clouds judgment but also reinforces the cycle of continuously investing in losing propositions, all in the hope of justifying past decisions.

Sunk Cost Fallacy in Business

Common Scenarios in Corporate Settings

Businesses frequently encounter the Sunk Cost Fallacy when deciding whether to continue funding projects that are no longer profitable. Corporate leaders often fall into the trap of pouring additional resources into initiatives simply because significant amounts have already been invested. This can happen during long-term projects, mergers, or technology implementations, leading to a cycle of escalating commitment.

Consequences of Ignoring Sunk Costs

The consequences of ignoring sunk costs in business settings can be severe. Companies may experience declining profit margins, waste of resources, and opportunity costs. Furthermore, employees could become demoralized if they perceive that decision-makers are not prioritizing overall company well-being. Ultimately, failing to acknowledge past expenditures as irrelevant to future decision-making can hinder growth and innovation.

Sunk Cost Fallacy in Personal Life

Relationships and Social Interactions

The Sunk Cost Fallacy can heavily influence decisions in personal relationships. People may stay committed to long-term relationships despite evident issues because they have invested significant time and resources. Additionally, the fear of losing past investments can overshadow rational thinking. It is crucial for individuals to recognize when past investments are preventing them from making healthier choices moving forward. Reflecting on the real value and future potential of the relationship, rather than past commitments, can aid in more balanced decision-making.

Personal Finance Implications

In personal finance, the Sunk Cost Fallacy often appears during financial decision-making. Individuals may hold on to failing investments because they have already spent money on them, despite better alternatives being available. By understanding this tendency, one can start to evaluate financial decisions based on current data and future potential rather than past expenses. This involves regular financial reviews that focus on optimizing current resources rather than clinging to past financial commitments.

Real-World Solutions to the Sunk Cost Fallacy

Recent Examples in the News

Over the years, multiple news stories have showcased businesses and individuals grappling with the Sunk Cost Fallacy. One notable case involved a large technology firm, which invested billions into a new product line, only to find it lagging in market appeal. Despite clear signs pointing towards an inevitable downturn, the firm chose to continue pouring resources into the venture. This decision illustrated the difficulties organizations face when already significant funds have been expended. Such situations often create a false hope of recovering sunk investments, leading to further losses.

Analysis of Outcomes and Lessons Learned

From these events, critical lessons emerge. One of the main takeaways is the importance of recognizing when it’s time to cut losses. By holding onto projects merely due to prior investments, businesses risk further financial detriment and wasted resources. Moreover, incorporating third-party evaluations can provide fresh perspectives, potentially saving companies from detrimental decisions. By understanding the Sunk Cost Fallacy and actively working against its pull, both companies and individuals can adopt more rational approaches to decision-making, promoting better outcomes over time. Importantly, these lessons underscore the necessity of strategic thinking before committing further investments.

Sunk Cost Fallacy: Overcoming Financial Pitfalls

Case Study: The Tech Startup Dilemma

In the bustling world of technology startups, many companies face the daunting challenge of knowing when to pivot or cut their losses. BrightFuture Tech, a promising startup, found itself trapped in the Sunk Cost Fallacy. The company had invested heavily in a mobile app development project that promised revolutionary features. However, during development, unexpected technical challenges and shifts in the market landscape rendered the app’s success increasingly doubtful. Despite these red flags, the leadership team was reluctant to abandon the project, largely because of the emotional attachment to their initial investment and efforts.

Strategic Solution: A Breakthrough Approach

Ultimately, BrightFuture Tech’s leadership recognized the need to overcome this fallacy. They sought advice from external consultants specializing in business strategy and psychology. Through guidance, they employed a strategy that involved revisiting their core business objectives and conducting a thorough cost-benefit analysis for all ongoing projects. The critical turning point was the introduction of “sunk cost meetings”, where team members could openly discuss their emotional connections and financial investments in various projects without bias.

Successful Outcome: Rethinking Investments

This process led to the tough decision to terminate the failing app project. Additionaly, resources were reallocated to more promising initiatives with a higher probability of success. Within months, BrightFuture Tech launched two new products that quickly gained traction in the market. Because of their decision to confront the Sunk Cost Fallacy, the company strengthened its market position and financial health, serving as an inspiration for other businesses facing similar dilemmas.