## Understanding Faulty Causation in Economic Claims

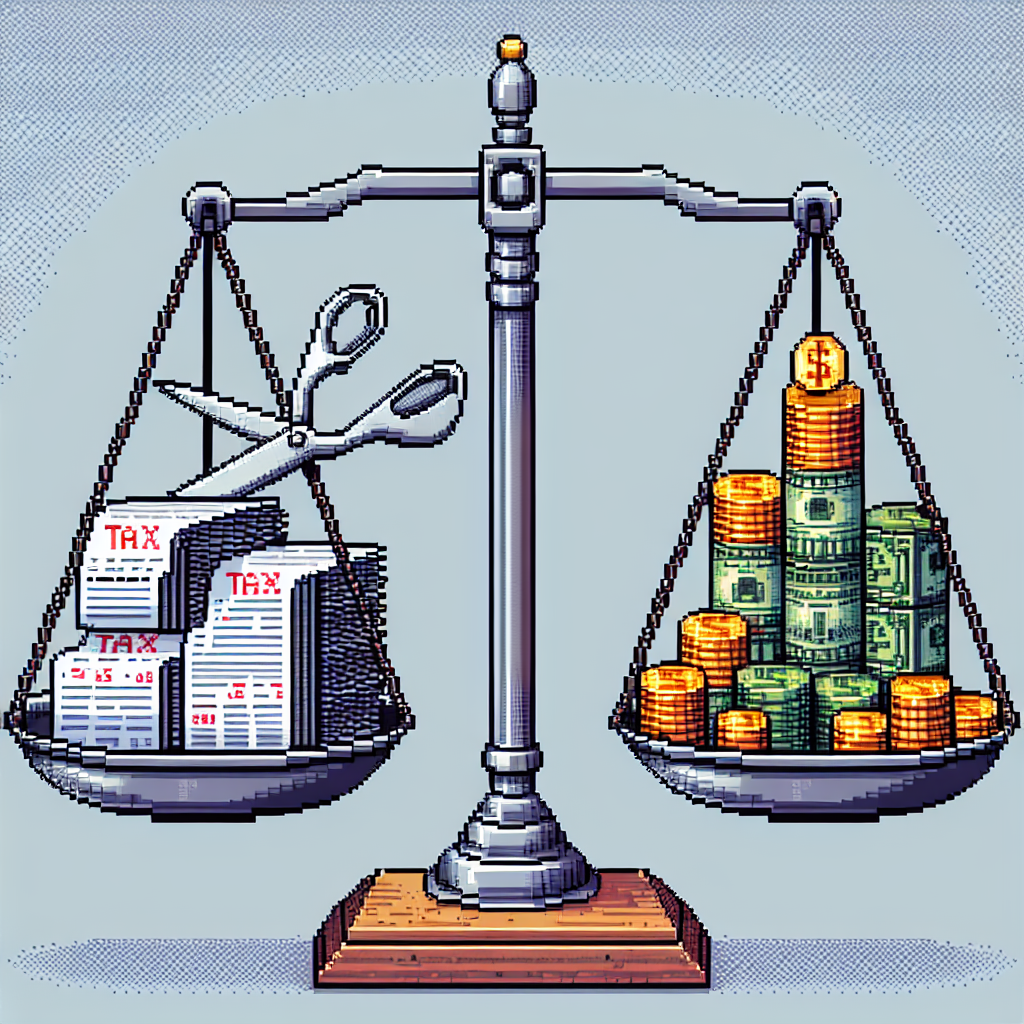

During a 2022 campaign speech, a politician advocated for tax reforms, proposing that cutting taxes would lead to an increase in government revenue. This concept, often debated, requires a nuanced understanding of economic principles.

### Step 1: Research the Source

To evaluate this claim, it is essential to review economic theories and gather empirical data from reputable economists and institutions. The relationship between tax rates and government revenue is intricate, influenced by multiple factors such as economic growth, consumer behavior, and governmental efficiency. Therefore, simply altering tax rates doesn’t guarantee predictable outcomes.

### Step 2: Check the Reasoning

The argument that reducing taxes will automatically increase revenue can lead to a misunderstanding known as Faulty Causation. The Laffer Curve theory suggests such a possibility under specific circumstances, yet it is not a universally applicable principle. Sound logical reasoning mandates examining evidence comprehensively and understanding the subtleties of fiscal policy. Additionally, different economic environments produce distinct responses to tax changes.

### Step 3: Check for Biases

It is crucial to recognize the role of political ideologies in shaping acceptance of economic claims. Reflect on whether personal beliefs might skew objective evaluation. Seeking diverse perspectives and analyses allows for a more comprehensive understanding. English sources provide a wide range of evaluations to consider, enriching the debate.

### Conclusion

In conclusion, the claim that cutting taxes will increase government revenue demands careful economic analysis and is not universally valid. Avoid accepting simplified assertions without evaluating supporting evidence and recognizing the potential for Faulty Causation in political discourse around economics.